Capitol Update - February 4, 2022

UEN Legislative Update

Feb. 4, 2022

Week Four of the 2022 Session: Action pops on School Funding, Governor’s School Choice, Parents Rights, and Tax Cuts. This UEN Weekly Report from the 2022 Legislative Session includes:

- Differences in the Governors, House and Senate SSA Proposals

- Thinking about per pupil expenditures and responding to simple generalizations

- Differences in the Governor, House and Senate Tax Plans

- Status of School Choice Conversations

- Bills Receiving Committee and Subcommittee Action

- Advocacy Action Steps for This Week

- Links to Advocacy Resources

- Members of the House and Senate Education Committees

Update on School Funding SSA: The Legislature is required by Iowa Code to set the increase in the State Cost Per Pupil (SCPP), also known as State Supplementary Assistance (SSA), within 30 days of the release of the Governor’s Budget. That deadline is Feb. 11. Here are the various levels of funding proposed, all of which continue the transportation equity payments and none of which include on-time funding or a proposal to support growth in preschool:

- Governor recommended an increase of 2.5% but did not include formula equity or additional transportation funding.

- House and Senate Democrats held a press conference on Tuesday announcing support of a 5% increase in the SCPP, which is about $300 million. They specifically mentioned a choice between proposed corporate income tax reductions, which they estimated at $300 million, and an adequate SSA amount.

- Senate: SSB 3090 sets the per pupil increase at 2.25% for SCPP and for categoricals. Continues the property tax relief payment, adds another $10 per pupil toward formula equity, and specifies that the appropriation to the transportation equity fund is the amount needed for full funding at the state average. This is the lowest per pupil increase of the proposals, matches the House transportation action and is the highest per pupil equity amount. This bill was approved in the Senate Education Committee 10-5 and moves to the Senate Calendar. UEN is registered opposed to this proposal, which falls short of the 5.0% requested. We do support the $10 toward per pupil equity and transportation funding in this proposal.

- House: HSB 658 sets 2.5% increase per pupil for SCPP and for categoricals. Continues the property tax relief payment, specifies that the appropriation to the transportation equity fund is the amount needed for full funding at the state average, and adds $5 per pupil toward formula equity. This is the highest SSA recommendation, below the Senate’s $10 per pupil formula equity, and matches the Senate language on transportation. The House also introduced HSB 660 which is a supplemental appropriation for $19.2 million. This supplement is prorated based on budget enrollment. The bill specifies that the supplement is miscellaneous income and is to be used for the increased cost of employing para-educators, substitute teachers, bus drivers, and administrative and support staff due to worker shortages, and other increased costs incurred by the school district resulting from goods and services price inflation.

The House and Governor have the high mark on SSA, so advocate with your legislators and encourage the House to hold firm and the Senate to match 2.5%. Thank both for the transportation equity funding and encourage the Senate to hold firm on $10 per pupil in formula equity. Although we would prefer the $19.2 million in the formula as additional SSA, we support HSB 660 and encourage the Senate to agree.

See the ISFIS New Authority Report for the impact of various SSA recommendations to your district. Change the dropdown box to any other percentage you’d like to compare.

See the UEN Issue Brief Adequate School Funding, which has additional school funding talking points and comparisons to economic measures you can share with your legislators.

Thinking About per Pupil Expenditures and Discussing Simple Generalizations

This week, there were tweets from voucher advocates stating,

“Iowa spent $17,550 per students in 2020. That’s $351,000 per classroom. The more you dig into education spending, the more you see we are not spending wisely.”

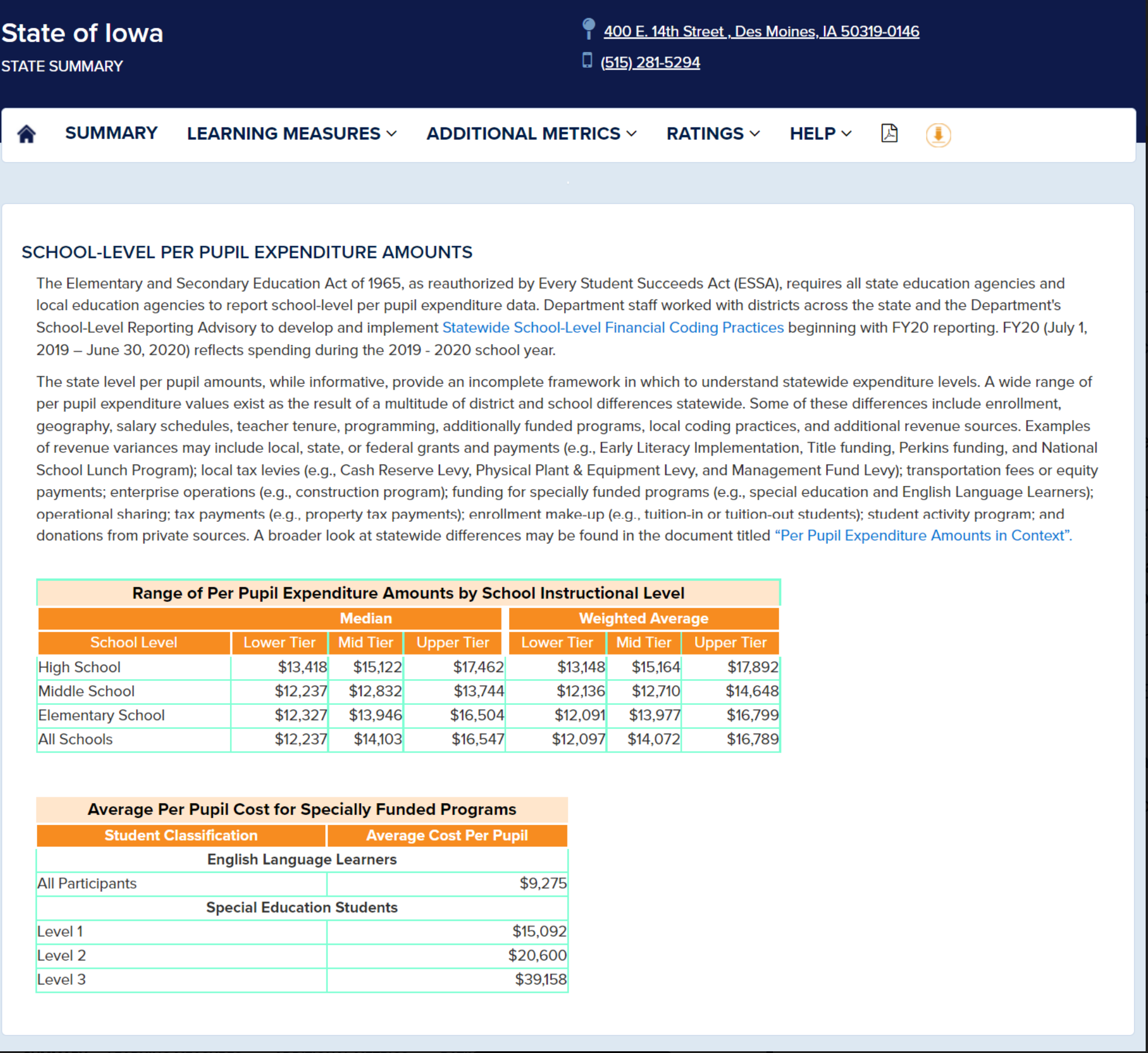

This number comes from the DE’s School Report Card Expenditure Reporting. The DE also has a helpful resource that provides the Context of Per Pupil Expenditures.

Our Observations:

- It includes all expenditures and many are duplicated. Example, a school pays a neighboring school for a whole grade sharing agreement (for their entire high school) and the neighboring district pays the teachers, buys the textbooks, pays for heating the classroom. This is another expenditure of the same dollar.

- This report includes all construction expenditures in the year in which they happen, so if Iowa City builds a $120 million high school, that technically inflates the average for all of Iowa's 485,000 students by about $250 per pupil. That benefit will be shared by Iowa City high school students for 30 or 40 years, so it's strange that it's only captured in the year it's spent, but that's the way the data collection works. Lots of construction is going on right now with low interest rates and the extension of the state penny. And some of that construction, like a recent athletic complex in Council Bluffs, was funded with private contributions, not tax dollars.

- The report includes special education expenditures too - the average tier 3 special education student costs $39,000.

- While we're on special education, many students are residents of one district but educated in the other. The resident district pays the receiving district (an expenditure) and the receiving district pays for the sped services (another duplicated expenditure.)

- AEA flow-through is recorded as a district expense. So are other things purchased from the AEA. However, the AEAs also use those funds to support private school kids and birth-5 kids and kids from 18-21 with special needs not counted in public school enrollment.

- PK - depends on how the district recorded it. In some cases, it's an expense, but the PK enrollment isn’t included in the divisor.

- Before and after school care or child care for which parents pay. The report doesn't talk about where the revenues came from. The underlying insinuation of the tweet implies tax dollars are not spent wisely, so this is an important distinction. The district uses the parent's funds to pay for staff, but that counts as an expenditure. Other parent-pay items, such as school lunch, may be in here too.

- Public school districts also provide transportation and textbook support to nonpublic schools that flow through the district’s accounting system, in addition to special education and professional development supports to nonpublic school students and teachers.

Here’s what that page of the Report Card shows; expenditures (sometimes duplicated) divided by enrollment (not including some students served) reports a range from $12, 327 to $17,892.

We don’t recommend engaging in a battle over the numbers, but it’s important to understand what your school district spends on the pupils you serve so you are fluent in advocating for resources for your students. Here are some suggestions for getting additional information.

- Look at your CAR – what are the total expenditures?

- Look at enrollment (including PK, dually enrolled privates, etc.).

- Also review the allocations spreadsheet on the DE’s website which includes everything except for capital expenditures (although debt levy to repay those expenditures is included). The allocations spreadsheet is found here: 20-21 allocation summary_rev 2.17.21.xlsx

- Also review the talking points from the UEN Issue Brief on Adequate funding, which references the 2019 US Census data, May 2021 https://www.census.gov/data/tables/2019/econ/school-finances/secondary-education-finance.html that reviews all like expenditures from every state excluding capital expenditures:

- Iowa slipped to 30th in per pupil public elementary and secondary school system expenditures, which is $1,280 below the national average. The national average is $13,187 per pupil expenditures with Iowa at $11,197.

- Since 2014, Iowa elementary and secondary education spending has increased 11.6%, while the national average increase has been 19.9%. In the Midwest region, Iowa grew more slowly than all states except Nebraska.

- Iowa ranks 40th nationally in the per pupil expenditure increase since 2014.

Use evidence that proves your funding is not adequate: fewer or no applicants for needed positions to serve students, increasing costs of supplies and curriculum, increasing natural gas and fuel prices, programs needed for students that cannot be provided or were recently cut. Be prepared to discuss this issue if your legislators write about it in their newsletters or bring it up in forums or on social media.

Tax Plan Comparisons

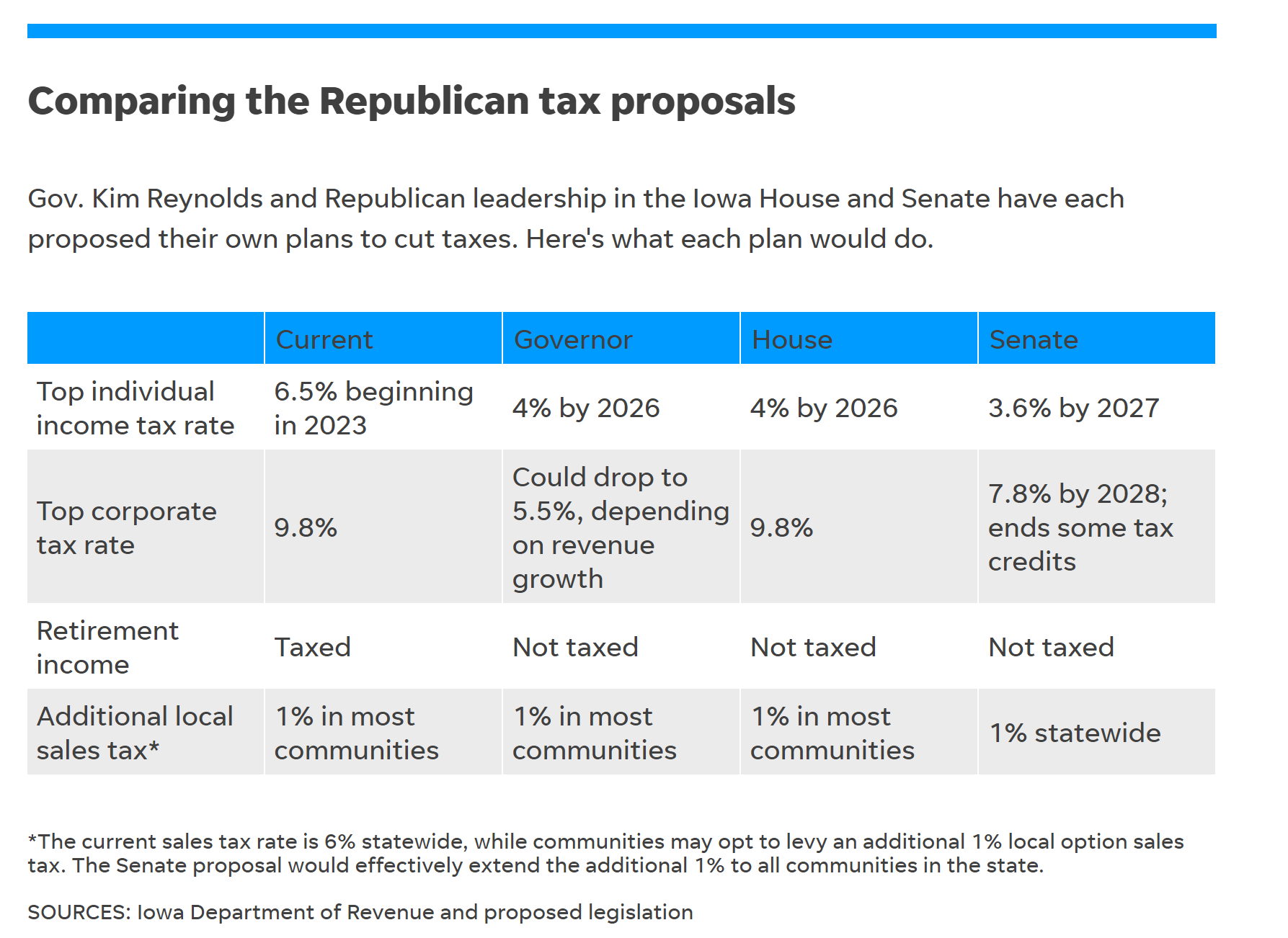

Last week’s report provided details of the House and Senate Tax Plans, HSB 626 House, which was moved forward out of subcommittee on Feb. 1, and the Senate’s bill SSB 3074 which was approved in the Senate Ways and Means Committee on Feb. 3. For reference, the Governor’s tax proposal is contained in HSB 551 and SSB 3044. The Des Moines Register had a graphic published this week that compares the various provisions of the proposals:

Fiscal Impact of tax plans: there has been a fiscal note published on the impact of the exclusion of retirement income from state income tax, estimated at $601.5 million in FY 2023, then about half that in the following year, normalizing at around $400 million annual reduction in state general fund revenue down the road. Although an official fiscal note on the impact of the other provisions has not been published, the Governor’s website estimates the flat tax to reduce state general fund revenue by $1.6 billion and the corporate income tax reduction has been discussed by Democrats as costing about $300 million. In total, somewhere between $2-3 billion reduction in state general fund revenues out of a $9 billion budget is on the table. UEN is registered opposed to these bills. We are not opposed to tax cuts, but oppose the magnitude of these proposals which will make it impossible to adequately fund public schools in the future.

School Choice Status

The Governor’s School Choice Omnibus bill, SSB 3080, was discussed in a Senate Subcommittee on Wednesday. See the bill description below. The bill could be considered in the Senate Education Committee this coming week. During the subcommittee, there were many Iowans who testified that this bill did not go far enough, that it should include homeschool students (it currently does not). If this plan unfolds similarly to other states who have created education savings accounts/vouchers, it is a slippery slope toward a costly and expansive voucher program costing upwards to half a billion dollars. The bill was approved in Subcommittee, 2:1 on party lines, moving it to the full Senate Education Committee.

See the UEN Issue Brief on School Choice, which has additional information about Iowa’s current school choice options and explains how vouchers have not netted positive results across the nation. UEN is registered opposed to this bill.

House Committee Action

HF 2218 Social Media Blocking: allows school districts to block internet social media sites at their schools if they choose to. The bill was approved unanimously in the House Education Committee and moves to the House Calendar. UEN is registered as undecided (we believe schools already have the authority to do this).

HF 2245 Telehealth Reimbursement: prohibits insurance providers from excluding payment to telehealth providers from other states. The bill was approved by the Committee on Human Resources and moves to the House Calendar. UEN is registered in support.

HF 2040 COVID Vaccines: prohibits licensed child care centers, elementary or secondary schools or colleges or universities from requiring enrollees to be immunized against COVID-19 in Iowa prior to July 1, 2029. Approved 15:5 by the full Education Committee and moves to the House Calendar. UEN is registered as undecided.

HF 2109 Hotline Numbers on Student IDs: requires public schools to include Iowa Crisis Hotline and text numbers on 7-12 student IDs if they have student IDs. Encourages this information on ID’s for grades 5 and 6. Allows schools to use up any existing stock before meeting these requirements. Approved by the House Education Committee 20-0. Moves to the House Calendar. UEN is registered as undecided.

House Subcommittee Action:

HF 2053 Teaching Restrictions: prohibits the state, school districts or administrators from requiring teachers to discuss current events or widely debated and currently controversial issues of public policy or social affairs. Requires a teacher who chooses to discuss such subjects to include diverse and disparate perspectives. Prohibits teacher from giving credit or grades for student work for, affiliation with, or service learning in association with, any organization engaged in lobbying for legislation at the local, state, or federal level, or in social or public policy advocacy. Prohibits school districts from accepting money from private individuals or sources for curriculum or instructional materials. Also states that, “a teacher shall not be compelled to affirm a belief in the so-called systemic nature of racism, or like ideas, or in the so-called multiplicity or fluidity of gender identities, or like ideas, against the teacher’s sincerely held religious or philosophical convictions.” As two members of the subcommittee declined to sign the report, the bill does not move forward to the full Education Committee. UEN is registered opposed to this bill.

HF 2085 Alternative Teacher Certification Program: requires BOEE to create a temporary initial teaching license for a teacher who completes an alternative teacher certification program. Requires the teacher to be at least 26-years-old, have a BA degree, and specifies the content and pedagogy required in the program. The bill requires an examination similar to one designed by a nationally recognized testing service and successful completion of the Praxis. Requires completion of a one-year clinical experience at no cost to the state, a school district, nonpublic or charter school. Sets requirements for in-state provider that must operate according to BOEE rules and out-of-state providers which must operate in at least 5 states and been in operation for at least 10 years. Requires the BOEE to treat the graduate of this program similarly to teachers from traditional programs. Prohibits this teacher from teaching special education during initial licensure. Requires the school district to submit a plan to BOEE on how they will provide the teacher with opportunities to obtain exposure to classroom management and instructional techniques, including special education, outside of the clinical experience. Requires BOEE to submit an annual report including numbers participating in this program and the success of the teachers coming out of this program. The Subcommittee recommended it move forward to Committee 2:1 with some amendments proposed. UEN is registered undecided.

Senate Committee Action

SF 409 Information Board Timelines: increases the time to file a public records or open meetings complaint with the Information Board after an incident from 60 to 90 days. Approved unanimously by the Senate State Government Committee. Moves to the Senate Calendar. UEN is registered as opposed to the bill.

SF 2195 Mental Health Loan Repayment: Creates a mental health loan repayment program under College Student Aid Commission. Applicants can receive up to $8,000 annually, maximum $40,000. Requires recipients to practice in certain shortage areas. Approved unanimously and sent to the Senate Calendar. UEN is registered in support.

SF 2197 Special Education Services in Private Schools: as amended in Committee, this bill requires the DE to convene a workgroup to study the provision of special education services to students with IEPs enrolled in private schools. The bill states members of the task force and requires the tax force to make recommendations and submit a report by Dec. 1, 2022. Although originally registered opposed to the mandate to provide special education services at private schools in SF 168, this amendment moves the UEN registration to undecided. Amended and approved unanimously and sent to the Senate Calendar.

SF 2202 Teachers Recruitment, Licensure and Student Loans Omnibus Bill:

- Teach Iowa Scholar Loans: requires that half of Teach Iowa Scholar loan forgiveness grants be offered to teachers in school districts, charter schools or private schools with more than 1,200 and half in those with less than 1,200 students enrolled. Allows more in one category if there are insufficient applicants in the other. Allows teachers from other states entering Iowa to be eligible for loan forgiveness if they provide a copy of an offer of employment from a school in Iowa.

- Nontraditional Preparation Program Requirements: requires BOEE to adopt rules. Allows a teacher intern license for teaching grades 6-12 to an applicant in a nontraditional program while the applicant completes the additional education requirements including: 1) must have graduated from an accredited college or university 2) have at least 3 years of post BA work experience, and 3) submit with the application a copy of an offer to work in an Iowa school. Before applying for their initial license, the applicant granted a teacher intern license must work under the supervision of a teacher coach or a mentor assigned by the district/nonpublic school and must complete an additional 15 hours of in-person coursework. If the school recommends the individual who has completed these requirements, they may apply for an initial teaching license.

- CTE Authorization: requires BOEE to adopt rules allowing an individual seeking a CTE secondary authorization to apply and if eligible, be issued the authorization prior to accepting an offer of employment with a school.

- Early Retirement and Teacher Recruitment from Management Fund: allows a school board to adopt a teacher recruitment program and include in the management levy an amount to pay the total estimated accumulated cost of the program. Requires the board to discuss either an early retirement program or a teacher recruitment program funded by management fund at a regular or special meeting prior to adopting the program. Requires the board to allow time for public comment on the program. Requires the board to allow each interested member of the public to speak regarding the program but may impose a time limit on individual comments if universally applied and required due to a large number of people wishing to speak. Prohibits the board from using the management fund for both purposes in the same budget. Prohibits the board from adopting either program for two years after using the management fund for the other program.

The bill was amended and approved by the Education Committee unanimously, moving it to the Senate Calendar. UEN is registered in support.

SSB 3079 Parents Rights: specifies that the following rights are reserved to the parent or guardian of a minor child – notwithstanding any provision of law to the contrary:

- to know what the board of directors of the school district is teaching the minor child,

- to access and review information related to who is teaching the minor child,

- to access and review information related to persons who contract with or otherwise receive moneys from the board of directors of the school district,

- to reasonable access to the minor child while the minor child is in school to ensure the minor child’s health and safety,

- to access and review information related to the minor child’s safety at school,

- unless otherwise prohibited by law, the right to access and review all school records relating to the minor child,

- to access and review information related to the collection and transmission of information related to the minor child,

- to access and review information necessary to ensure the accountability and transparency of the board of directors of the school district.

The bill also says that the school district shall not require any student to engage in any activity, including instruction or any test, assessment, or other means of evaluation that involves obscene material without the express prior written consent of the student’s parent or guardian. The amendment changes from “obscene material” to “explicit sexual material.”

Additionally, Iowa Code Chapter 22 Requires certain records to be confidential for students (as does federal FERPA requirements) and employees. Since this only applies to items not otherwise restricted by law, these laws must still be followed. The amendment specifically requires protection of confidential information. The amendment also includes language on reasonable access and is expected to clarify that schools are not responsible for content accessed on student’s individual devices. UEN is registered as undecided on the original bill but may change that to support once the amendment is attached.

Senate Subcommittee Action:

SSB 3080 Governor’s School Choice Omnibus. This bill has 6 different divisions. UEN is registered opposed to the bill. The summary of each division follows:

Division I School District Transparency- Adds a penalty specific to non-compliance of these requirements to 257.17, requiring the DE to reduce state aid payments for each day the school district is in violation of these transparency requirements. Requires the DE to withhold an amount in proportion to the actual damages caused by the district’s violation of these requirements.

New Code Section 279.76 Transparency and State Standards

- Requires school boards to prominently publish the following on the district website:

- Course Syllabus or written summary of material to be taught in each class in the school district, sortable by subject area, grade level and teacher.

- How each class in the district meets or exceeds Iowa Code 256.11 education standards, sortable by subject area, grade level, and teacher.

- Titles of all textbooks, books, articles, videos, and other educational materials used for student instruction in each class or links to the internet sites containing them.

- Procedures/policies in effect for the documentation, review and approval of all textbooks, books, articles, outlines, handouts, presentations, videos, and other educational materials used for student instruction. (Procedures/policies of the school board, principals, administrators, teachers and any committee created by any of them.)

- Comprehensive list of all books available to students in libraries operated by the district.

- Flowchart developed by DE showing procedures or policies for parents to request removal of a book in the library

- Requires the above information to be updated on or before Aug. 23 and Jan. 15 of each school year and requires the school board to notify parents that the information was updated (both notice on the website and in a newsletter or other written communication distributed to parents).

- Requires the information to be maintained on the website and accessible to the public for at least 5 years.

- Specifies that this section shall not be construed to require the school board to: 1) reproduce materials not created by a teacher employed by the district, 2) distribute any educational materials in a way that infringes on intellectual property rights.

- Defines “used for student instruction” to mean a textbook, book, article, syllabus, outline, handout, presentation, video, or other education material that is or will be assigned, distributed or presented to students in a class required by 256.11 (educational standards), or as required by the school board, or is or will be created by the school board or a teacher employed by the board.

New Section 279.77 Protocols for selection, review, reconsideration and removal of library materials.

- Requires school boards to adopt protocols for selection, review, reconsideration and removal. Protocols are required to include 1) process for selection, reconsideration and removal of materials from the library, 2) lawful and ethical use of information resources including plagiarism and intellectual property rights, 3) a process for a parent to request reconsideration or removal of materials. That process must include:

- School district shall conduct a review of the request and respond in writing, including the disposition of the review, within 10 business days or a later date if parent/district agree.

- Parent may request the school board to review the school district’s disposition. Board shall act on the disposition at the next regularly scheduled board meeting but no later than 20 business days after the board receives the request (later date OK if parent and district agree in writing). School board may either affirm or reverse the school district’s decision.

- Parent may appeal school board’s decision to the state BOE under Iowa Code 290.1.

- If the district or school board fails to respond according to these timelines, the parent may appeal to the state BOE, which may then direct the district to respond and take any other action allowed for accreditation compliance (which now includes potentially withholding state aid for every day of non-compliance)

- Requires DE to create a procedure flowchart and provide it to all school districts.

Division II Student First Scholarship Program (ESAs/Vouchers). New Code Subsection 256.9 (65) Requires the State BOE to adopt rules relating to administration, application requirements and application processing timeline.

New Code 257.11B Student First Scholarship Program

- Begins July 1, 2022 and for each succeeding year and caps participation in the program at 10,000.

- Allows students attending an accredited nonpublic school (defined in IC 285.16) as eligible, including 1) household income below 400% of FPL (up to 5,000 scholarships) 2) student with an IEP (up to 5,000 scholarships) and 3) students who received one in the prior year. If not all 5,000 slots are claimed in either category, additional scholarships may be given in the other.

- Scholarships are made available to parents for payment of qualified educational expenses for Iowa residents.

- Eligibility: by Jan. 1 of the preceding school year for which participation is requested, the pupil must either be enrolled in a public school, eligible to enroll in kindergarten, or received the scholarship in the current year. Parent submits application to DE. Application must include certification from the private school of the pupil’s enrollment.

- Requires DE to determine by Feb. 1 the number of pupils in each school district approved to participate and notify parents. DE must approve applications on a first-come, first-served basis by date of application submitted. Approved for one year and must be resubmitted annually.

- DE assigns either recipient a scholarship in the amount of the sum of the following for the same school budget year:

- Pupils weighted enrollment that would otherwise be assigned to the pupil if attending public school X ( 88.4% of SCPP minus statewide average foundation property tax PP)

- Categorical Per Pupil supplements: TSS, PD, EICS, TLC)

- AEA TSS and PD per pupil

- Creates a Student First Scholarship Fund. DE controls it. Standing unlimited appropriation to the fund to pay the amount necessary for all scholarships approved for the fiscal year. Gives DE director power to make/enter into contracts to administer the fund, procure insurance, contract with private financial management firm in collaboration with the state treasurer, including providing debit cards or checks payable from the student’s account, conduct audits, and adopt rules.

- Requires DE to create an account for each student, deposit funds by July 1 which parents can access immediately.

- Prohibits the private school from a refund, rebate or sharing any such payments made to the private school with the parent or pupil.

- Funds carry forward to the next year if not expended as long as the student remains eligible.

- Defines qualified educational expenses: private school tuition and fees, textbooks, fees or payments for education therapies, including tutoring or cognitive skills training, curriculum fees, software and materials for the course of student for a specific subject matter or grade level, tuition for vocational /life skills education approved by DE, materials and services for student with disabilities (includes costs of paras and assistants with required training), standardized test fees, AP or other postsecondary admission/credentialing exams, qualified expenses defined in 529 plans excluding room and board, and other expenses incurred by the parent directly related to the student’s education at the private school, including those with independent accreditation approved by DE. Allows purchase of a computer for the student every four years. Prohibits expenditure for transportation, food consumed by the pupil, clothing, disposable materials including but not limited to paper, notebooks, pencils, pens and art supplies.

- Defines misuse as fraudulent. Requires DE to close the account and transfer remaining funds to the state GF. Requires DE to recover fraudulent expenditures, including through litigation if necessary. Prohibits a fraudulent parent from future participation.

- If a student withdraws or is expelled, private school and parent both notify DE. Expulsion makes student ineligible for ESA the remainder of the year. Withdrawal also makes student ineligible for remainder of the school year, unless parent submits written notice of change of residence and certification from another private school that the student is enrolled. If student is expelled, DE closes the account, transfers remaining funds to state GF, and requires DE to recover funds spent during the year prior to expulsion from the parent, including via litigation. For withdrawal without change of residence, DE closes the account, transfers funds to state GF, and requires DE to recover funds from the parent if expenditures exceed the proportion of the year attended at the private school. If withdrawal was due to a change in residence, but the student did not enroll in another private school, DE closes the account, returns balance to the GF. Student who withdraws or is expelled is ineligible for ESA for the next school year.

- Requires balance in the ESA to be transferred to the state GF when the student graduates HS or turns 21, whichever happens first.

- Allows parent to appeal any DE decision to the state BOE. DE notifies parent of appeal process with any decision. State BOE establishes the appeal process and posts it on the DE website.

- Prohibits the state or political subdivision from exercising any authority over a private school and does not require a private school to modify its academic standards for admission or educational program in order to receive payment from a parent from the pupil’s account. Specifies that this Code section does not expand the authority of the state or political subdivision to impose regulations on the private school that are not necessary to implement it. Specifies that the private school is not an agent of the state or political subdivision by accepting a payment from the account. States that rules adopted by the DE to implement this section that impose an undue burden on a private school are invalid. Also requires that a private school that accepts funds from an account shall be given the maximum freedom possible to provide for the educational needs of the school’s students, consistent with state and federal law.

- Specifies that funds received by a taxpayer for the voucher are state tax exempt, retroactive to the 2022 tax year.

- Sets up special timelines for July 1, 2022 participation:

- Parent application to DE is due by May 1 for student currently enrolled in public school or incoming kindergarteners who will attend private school the next fall and intends to attend for the entire school year.

- DE is required to determine the number of pupils who will receive the ESA and notify parents by June 1.

- Gives the DE emergency rulemaking authority

Division II Continued: Small School Supplement Fund Provisions. New Code Subsection 257.16E Creates a student first enrollment supplement fund in the state treasury under control of DOM.

- For each year on or after July 1, 2023, standing unlimited appropriation in the amount of ESA’s approved for the base year X the remaining amount (waiting for the fiscal note, but we believe this to be the statewide average of the SCPP supported by property tax)

- Requires DOM to distribute the funds equally to districts with budget enrollment of 500 or fewer students.

- Requires these supplements to be paid in the same manner as state aid.

- Specifies that these supplements are miscellaneous income. Does not include the supplements in the district cost or impact the receipt or amount of the 101% budget guarantee.

- If there are any funds in the Enrollment Supplement Fund, specifies that they not revert.

Division III Social Studies Instruction: Requires the ½ unit of US Government to include:

- Current law requires instruction on voting procedure, study of the Constitution/Bill of Rights and an assessment of the student’s knowledge. This bill requires a specific assessment of the student’s knowledge of US government and civics that includes the nature, purpose, structure, function, and history of the US government, the rights and responsibilities of citizens of the US, and important US government and civic leaders. The most recent version of the civics test developed by the US citizenship and immigration services is required.

- Requires school districts and private schools to submit results of the test to the DE on or before June 30 annually.

- Allows the school district or private school to modify the test for a student with an IEP.

- Requires students to answer 70% of the questions correctly as a condition for graduation. Allows the student to retake the test as many times as necessary.

Division IV Private Instruction – Special Education

- Eliminates the requirement that the AEA special education director approve a child with an IEP to receive Competent Private Instruction (home school CPI).

- Allows a parent of a child with an IEP in CPI to request dual enrollment and requires services to be determined and provided based on Iowa Code 256B and administrative rules.

Division V Open Enrollment

- Allows the denial of an open enrollment request by either the sending or receiving district for a sibling or stepsibling of a student who open enrolls for good cause due to repeated acts of harassment of the student that the district cannot adequately address, the consistent failure of the school district meet the basic academic standards or serious health condition to also be appealed to the state BOE under section 290.1.

- Allows that sibling to participate in varsity athletics without a waiting period 282.18 (11).

Division VI Teacher Librarians: Specifies that a teacher-librarian license not require a master’s degree.

SF 2107 Technology Work Group: requires the DE to convene a workgroup to study the impact of technology on students’ cognitive learning and academic performance for PK-6th grade enrolled students. Requires the workgroup to submit a report by Dec. 2022. The Subcommittee met and recommended passage. UEN is registered as undecided.

Advocacy Actions This Week

- Always start with a thank you! See the 2021 Legislative Session Successes on the UEN website and find one you are grateful for them accomplishing. Weigh in your support on the additional flexibility to recruit and retain teachers and grow our teacher workforce.

- Explain the SSA numbers to your legislators, especially in light of inflation and workforce shortage. Talking points:

- Supplemental state aid is the biggest source of per pupil funding in Iowa, but our funding has not kept pace nationally, putting our students and state at a disadvantage. Sufficient funding provides for a high-quality education that translates to a successful future and economic growth in our state.

- As a result of the legislature eliminating the Commercial and Industrial Replacement payment for school districts but increasing the foundation level, the cost of school aid will increase by $59 million without providing any new money to school districts. The funding source becomes the state general fund instead of local property taxes.

- Inflation and cost-of-living increases should be considered when determining school aid funding. School districts must pay competitive salaries to retain teachers and staff, especially during a labor shortage. The legislature should provide funding that considers the impact inflation has on recruiting and retaining school employees. PERB has set a CPI-U of 7.5% for June arbitrations. (Although arbitrators are limited to the lower of 3% or that CPI-U rate, the inflation factor is a sign of private-sector wage growth and competition for school employees.)

- School funding is enrollment-driven and increases in enrollment impact the supplemental state aid amount. On the flip side, declining enrollment combined with low SSA means more rural schools will have to consolidate or face closure by the state because they depend on adequate state funding to remain open.

- Low SSA amounts also lead to more districts being eligible for budget guarantee, which shifts the funding burden to local property taxpayers. At the Governor’s proposed 2.5% SSA, 82 districts would be eligible for the budget guarantee at a total cost to property taxpayers of $9.1 million.

Find more SSA information and talking points in the UEN Issue Brief on Adequate Funding on the UEN website here.

- Shore up Voucher Opposition: Circle back with your legislators who have previously told you they opposed vouchers and reiterate key messages:

- Use public dollars for public schools. Period.

- Public funds require public accountability and transparency.

- A slippery slope toward a costly an expansive voucher program.

- Iowa already has many parent choice options

Gratitude: Tell your legislators and the Governor thank you for the preschool funding supplement through the SBRC. THANK YOU for getting that done. (We will need to do it again this coming year.)

Connecting with Legislators: To call and leave a message at the Statehouse during the legislative session, the House switchboard operator number is 515.281.3221 and the Senate switchboard operator number is 515.281.3371. You can ask if they are available or leave a message for them to call you back. You can also ask them what’s the best way to contact them during session. They may prefer email or text message or phone call based on their personal preferences.

UEN Advocacy Resources: Check out the UEN Website at www.uen-ia.org to find Advocacy Resources such as Issue Briefs, UEN Weekly Legislative Reports and video updates, UEN Calls to Action when immediate advocacy action is required, testimony presented to the State Board of Education, the DE or any legislative committee or public hearing, and links to fiscal information that may inform your work. The latest legislative actions from the Statehouse will be posted at: www.uen-ia.org/blogs-list. See the newly released 2022 UEN Advocacy Handbook, which is also available from the subscriber section of the UEN website

Education Committee Members in the Senate and House:

Senate Members

- Amy Sinclair (R, District 14), Chair

- Jeff Taylor (R, District 2), Vice Chair

- Herman C. Quirmbach (D, District 23), Ranking Member

- Jim Carlin (R, District 3)

- Claire Celsi (D, District 21)

- Chris Cournoyer (R, District 49)

- Eric Giddens (D, District 30)

- Tim Goodwin (R, District 44)

- Craig Johnson (R, District 32)

- Tim Kraayenbrink (R, District 5)

- Ken Rozenboom (R, District 40)

- Jackie Smith (D, District 7)

- Annette Sweeney (R, District 25)

- Sarah Trone Garriott (D, District 22)

- Brad Zaun (R, District 20)

House Members

- Dustin D. Hite (R, District 79), Chair

- Skyler Wheeler (R, District 4), Vice Chair

- Sharon Sue Steckman (D, District 53), Ranking Member

- Jacob Bossman (R, District 6)

- Holly Brink (R, District 80)

- Sue Cahill (D, District 71)

- Cecil Dolecheck (R, District 24)

- Tracy Ehlert (D, District 70)

- Joel Fry (R, District 27)

- Ruth Ann Gaines (D, District 32)

- Eric Gjerde (D, District 67)

- Garrett Gobble (R, District 38)

- Chad Ingels (R, District 64)

- David Kerr (R, District 88)

- Mary Mascher (D, District 86)

- Thomas Jay Moore (R, District 21)

- Sandy Salmon (R, District 63)

- RasTafari Smith (D, District 62)

- Ray Sorensen (R, District 20)

- Art Staed (D, District 66)

- Henry Stone (R, District 7)

- Phil Thompson (R, District 47)

- John H. Wills (R, District 1)

Contact us with any questions, feedback or suggestions to better prepare your advocacy work:

Margaret Buckton

UEN Executive Director/Legislative Analyst

margaret@iowaschoolfinance.com

515.201.3755 Cell