Capitol Update - April 17, 2025

UEN Legislative Update

April 17, 2025

(Download this week's printable UEN Legislative Update)

This UEN Weekly Report from the 2025 Legislative Session includes:

- SSA Awaiting Signature

- Session Timetable (Week 14)

- Floor Action This Week (Including Civics Test for Graduation and Chronic Absenteeism Clean-up)

- Property Tax Relief Round II: More Details

- HF 787 Education Omnibus Still Pending

- Advocacy Actions for the Week and Resources

SSA to the Governor

Last week, the Senate moved SF 167 forward, setting a 2% increase in the cost per pupil, by amending the House’s plan. The House concurred. The agreement included additional investments. See the April 10 weekly report for details. Once the official signed copy arrives in her office, the Governor has three days to sign it. We expect her to sign it once it is received. UEN was registered in support of the House proposal.

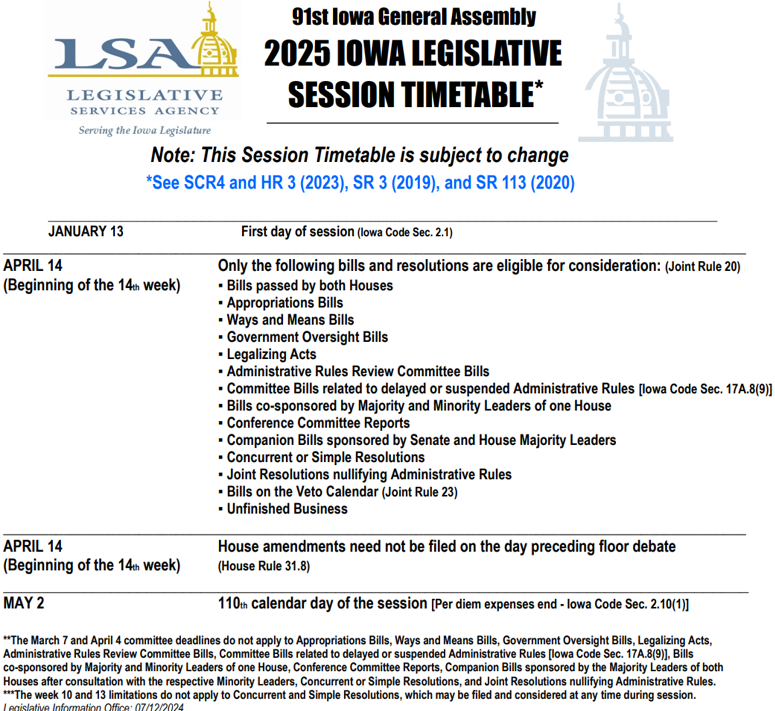

Session Time Table

The 14th week of session allows debate on any bills on the House and Senate calendars, unfinished business calendars, appropriations bills, ways and means bills, and leadership bills. Two weeks away, May 2, is the last day of per diem expenses, after which, legislators must cover their own expenses when coming to Des Moines. They typically strive to complete action by this time.

Floor Action This Week

- HF 190 Online Summative Assessments: allows virtual schools and programs to provide state tests online, with some proctoring and other requirements. The Senate approved it, 44:2, sending it to the Governor. UEN supports.

- HF 316 Industry Recognized Credentials and Career Pathways Content: requires DE to create and track industry-recognized credential certificates for high school graduate records and career pathways content in middle school grades 5-8. The Senate approved it, 45:0, sending it to the Governor. UEN is undecided.

- HF 390 Childcare Worker Physicals: strikes the pre-employment physical and requires it to take place within 6 months of employment. The Senate approved it, 32:15, sending it to the Governor. UEN is undecided.

- HF 393 Measuring School Dropouts: does not count a second or subsequent dropout in school performance measures of a student who drops out, reenrolls, and drops out again. UEN supports. The Senate approved it, 47:0, sending it to the Governor.

- HF 441 Employment Appeals Matters: transitions PERB duties to Dept. of Inspections and Appeals (DIAL) and Iowa Employment Appeals Boards (EAB). UEN is undecided. The Senate approved it, 44:0, sending it to the Governor.

- HF 471 Concussion and Brain Injury Providers: allows PhD of Psychology with specialty training in neuropsychology or concussion management to attend to students. UEN is undecided. The Senate approved it, 47:1, sending it to the Governor.

- HF 706 Open Meetings Laws: increases penalties for violations of open meetings law, requires local government officials to receive training on open meetings, amended to exempt state building video cameras and badge access data for state employees from public records law. UEN is undecided. The Senate amended and approved it, 34:13, sending it back to the House.

- HF 870 Religious Instruction Absences: requires schools to excuse students while attending religious instruction up to 5 hours a week. Allows parents to bring a civil action. UEN was opposed to an earlier version, which required school districts to give course credit for the religious instruction. When that requirement was removed from the bill, we changed our registration to undecided. The Senate approved it, 47:0, sending it to the Governor.

- SF 369 Civics Test for Graduation: amended in the Senate to delay implementation, having it first apply to 2026-27 graduates. Requires high school graduates to pass the 100-question test given to immigrants in attaining citizenship, with at least 60% correct, as a condition of graduation. The bill allows for accommodations for English Learners and students with disabilities. UEN is opposed but appreciative of the timeline change and the ability to offer accommodations. The Senate approved it, 38:7, sending it back to the House. The House concurred in the Senate amendment, 60:33, sending it to the Governor.

- SJR 11 Supermajority Tax Amendment: this bill would put before the voters a Constitutional amendment to require 2/3rds majority of legislators to raise income taxes. It was approved by the Senate, 32:15, sending it to the House. This resolution was passed in the prior biennium. If agreed to by the House, it will be on the General Election ballot for Iowans to approve. UEN opposes.

- SF 277 Chronic Absenteeism Corrections: Fixes the certified letter issue allowing local discretion on the best of multiple options for contacting parents, clarifies exceptions (adds weddings, funerals, reasonable travel time, military exceptions to board policy requirements), has model policies which county attorneys may use in addressing chronic absenteeism and truancy, allows district discretion on school engagement meetings (school engagement meetings are required for students for whom absences are impacting achievement). Approved by the House, 93:0, on to the Governor. UEN supports.

- SF 574 Retainage Limits: lowers the maximum retainage to construction projects from five to three percent. The House approved it, 90:0, sending it to the Governor. UEN is undecided.

- SF 175 Pregnancy Development Video: requires school districts to include instruction related to human development in the womb, a high-definition ultrasound video showing presence of organs, and that depicts the humanity of the unborn child. Requires the state Board of Education to adopt rules to implement. The House amended the bill to apply beginning in grades 5-6 during Human Growth and Development instruction and to grades 7-8 and 9-12 during health coursework. Defines research-based scientific evidence. The House approved, 60:31, sending it back to the Senate. UEN is opposed.

Property Tax Relief Round II: More Details

On Wednesday, April 9, new versions of property tax reform were introduced in the House and Senate Ways and Means Committee. Rather than amend the prior bills, new study bills were introduced; SSB 1208 in the Senate, with a subcommittee of Senators Dawson, Peterson, Rowley, Schultz and Winckler, and HSB 313 in the House, with a subcommittee of Representatives Kauffman, Bloomingdale, McBurney, Wilson and Wulf. The following includes important information, including changes from the original proposals:

- Changes Valuation: flips a switch rather than phasing in changes on valuations and levies: eliminates rollbacks and cuts levy rates effective July 1, 2026. Sets a homestead exemption to $50,000.

- State Assumes Cost of Additional Levy: buys down the school additional levy with state aid, effective July 1, 2026.

- Limits City/County Valuation Growth: but allows a higher rate of growth if inflation (CPI-U) is higher. Defines new construction and allows valuation growth to include new construction to valuation.

- Impact on Bonding/Infrastructure Capacity: halves PPEL and Debt levy rates July 1, 2026. Sets maximum levies of $0.165 for board-approved PPEL, $0.67 for voter-approved PPEL, $1.35 and $2.025 for the two bond issue thresholds. (Takes out the blackout period or moratorium on votes from Version I of the bills.) Specifies that levies approved before July 1, 2026 are subject to these rates.

- Exception to Lower Levies: allows a board resolution by April 30 preceding the budget year if a debt obligation is due or refunded or refinanced. Specifies, however, for any refund or refinance in the year beginning July 1, 2025, the rate may not exceed 50% of the levy rate.

- SAVE Changes: Cancels and redirects Property Tax Equity and Relief (PTER) Fund diversion into the SAVE fund – somewhere between $80-$100 PP increase in SAVE capacity). Returns any remaining (Property Tax Replacement Payments) PTRP and PTER funds transferred back to SAVE or the state General Fund.

- Eliminates wind rollback: currently taxed on 0-25% of net acquisition cost for 6 years, then at 30% of acquisition cost in future years. Sets wind valuation at 100% of acquisition cost going forward.

- Education Services and Media Services: specifies these line items be included in the districts’ combined district cost, currently funded with property taxes (becomes state aid with 100% of foundation threshold).

- Lowers school formula levies:

- Regular foundation base set at 100%.

- Special education foundation base set at 100%.

- Reorganization incentives cut in half as reorganizations phase in.

- Sets uniform foundation levy at $2.97 (currently $5.40).

- Management Fund Provisions

- Requires districts to report to the School Budget Review Committee (SBRC) by November 15, 2025, if the FY 2025 ending balance exceeds 100% of FY 2025 total expenditures.

- Requires SBRC to review and determine the appropriateness of establishing Management Fund unexpended fund balance limitations for fiscal years beginning on or after July 1, 2027. Requires SBRC to make recommendations to the General Assembly by Feb. 1, 2026.

- Limits Management Fund Taxing Authority based on unspent balances beginning July 1, 2027.

- Phase-In Schedule for Maximum Management Fund Balances:

|

Fiscal Year |

Maximum Allowable Fund Balance |

|

2028 |

180% |

|

2029 |

175% |

|

2030 |

170% |

|

2031 |

165% |

|

2032+ |

160% |

- Calculation example

- To calculate the maximum for 2028, take the average expenditures of 2024, 2025, and 2026, multiply by 180%, and subtract 2026 unexpended fund balance as defined in 257.2 (13) (unreserved and undesignated fund balance).

Next Steps: The Subcommittees of the House and Senate Ways and Means Committees must schedule a meeting to move the bill forward to the full Committee. The Ways and Means Committees will have to meet and move the bills forward. Once a bill is approved by the Committee, the Legislative Services Agency fiscal staff is required to publish a fiscal note, which estimates the impact of the bill’s provisions on the state budget and local governments. The Full House and Senate bodies will need to approve the bill in each chamber in an identical form. See advocacy actions below.

This proposal is very complicated. We appreciate the work of the entire education community. Special thanks to the many school advocacy groups, partners and school leaders working on understanding the impact of this bill. Thanks to the experts at Piper Sandler for working on the numbers. Thanks to IASBO for allowing a discussion at their conference today. Thanks to IASB and SAI for working together on helping the legislature understand needed corrections. Thanks to all of you for reading this far and for expressing your concerns to legislators.

HF 787 Education Omnibus Action (Includes TSS)

The Senate amended and passed this week, the Governor’s HF 787 Education Omnibus bill. The bill was approved in the House on March 18, nearly unanimously. The provisions of the bill include:

- TSS calculations, an error correction process for incorrect experience reported last year, and 2% growth ($13.09 per pupil added to district TSS per pupil amounts after DOM calculates the amount needed to meet the new minimums, including the employer share of FICA and IPERS).

- Reinstates the TeachIowa Job posting site (strikes the requirement for school districts and AEAs to post job openings on the Workforce Development Site).

- Creates a mechanism for districts to receive reimbursement for high-cost out-of-state placements (DE takes enough off the top of the state foundation aid for these high-cost placements, so all districts share in the cost).

- Sets a $50K minimum pay for returning retirees.

- Provides student teaching flexibility for Intern Teachers.

The Senate amendment specified that the $50K minimum for IPERS returning teachers applies to full-time teachers and also required the Job Posting in TeachIowa to comply with Iowa Code 216.6 (do not discriminate against a list of factors). The Senate passed the bill 47:0, sending it to the House. UEN is registered in support.

UEN Advocacy Resources

Check out the 2025 Session Advocacy Handbook, which has everything advocacy beginners and experienced pros can use to advocate with legislators, at the Statehouse or back in your district. Find the handbook on the UEN Advocacy Website here: https://www.uen-ia.org/advocacy-handbook

Advocacy Actions This Week

Start with a thank you! Thank legislators for getting SSA to the Governor’s desk and for including the $5 DCPP equity piece, the increase in transportation equity funding, or just for getting it done. Even though it’s lower than UEN requested, we are grateful they came to a decision. Also, say thanks to both Senators and Representatives for the SF 277 Chronic Absenteeism provisions.

Property Tax Relief Proposals: Questions & Comments:

- Keep asking questions. Brainstorm with them about unintended consequences. Can we prevent some bad outcomes (e.g., add in SBRC authority for a school board to levy the Management Fund in spite of the fund balance limitation for unusual circumstances)?

- Do they know the outcome, how this combination of ideas will change their own property taxes, or those of their neighbors, let alone entire school districts?

- Encourage a deliberate, careful review of the impact before jumping to change. It would be good to continue to work on these proposals over the interim rather than rush something through and discover an unintended consequence later.

- We appreciate the improvements in Version II of the bill, in the areas of PPEL and Debt Levies, including removing them from the levies limited to 2% growth. However, cutting those levies in half, when valuations will not double, lowers PPEL and debt levy capacity statewide. It lowers those capacities significantly for many school districts.

Property Tax Relief Proposals: Suggested Amendments to the Bills:

1. Allow districts to request the ability to levy more management fund revenue despite the proposed limitations if they can demonstrate unique or unusual circumstances (perhaps a destructive weather event and a lawsuit occur in the same year).

2. Pay for the additional levy buydown with funds out of the Taxpayer Relief fund to the state general fund so that the State can continue to pay for adequate school funding and other essential state services.

3. Do not cut PPEL and Debt levies in half. At 66% of prior levy rates, capacity would be closer to current statewide capacity. Allow districts to use higher levies to refinance bonds and pay them off early, saving taxpayers real dollars.

TSS Calculations: Your decisions around continuing teaching contracts and settling negotiations are dependent on knowing both the SSA rate and the TSS per pupil for a school district. (Thanks for SSA, but please get HF 787 TSS Calculation over the finish line in the House.)

Preschool: Encourage both Representatives and Senators not to forget public schools when considering the Governor’s Child Care Continuum bills. Those bills have not progressed in either chamber. Public schools need funding for initial preschool programs to expand access to preschool. Research shows that quality preschool for enough hours has great benefits (Perry Preschool Project, with $17 returned benefit for every $1 invested, had a minimum of 15 hours a week, which is 50% more time than Iowa’s current SVPP funds). Your own district data on the benefits for those students in full-day preschool is really important to share. Iowa’s neediest students not currently accessing either PK or child care might be best served in an all-day PK program. Serving these neediest students well will go far in achieving state priorities, including literacy and math outcomes. The Governor’s grants and 1.0 weighting for most at-risk 4-year-olds are compatible policies, both necessary to establish a full continuum of care and instruction. Express thanks to House HHS and Senate Education Committee members for amending the bills to require licensed teachers in the new community provider authorized programs. See the UEN 2025 Quality Preschool Issue Brief for additional information.

Connecting with Legislators: To call and leave a message at the Statehouse during the legislative session, the House switchboard operator number is 515.281.3221 and the Senate switchboard operator number is 515.281.3371. You can ask if they are available or leave a message for them to call you back. You can also ask them what’s the best way to contact them during session. They may prefer email or text message or phone call based on their personal preferences.

Find out who your legislators are through the interactive map or address search posted on the Legislative Website here: https://www.legis.iowa.gov/legislators/find

Other UEN Advocacy Resources

Check out the UEN Website at www.uen-ia.org to find Issue Briefs, these UEN Weekly Update Reports and Videos, UEN Calls to Action when immediate advocacy action is required, testimony presented to the State Board of Education, the DE or any legislative committee or public hearing, and links to fiscal information that may inform your work. The latest legislative actions from the Statehouse will be posted at: www.uen-ia.org/blogs-list.

Bill Action This Week

Check out our separate Bill Tracker for all the bill actions and details for the week.

Contact Us

Stay tuned for a thorough explanation of Statehouse actions this week.

Margaret Buckton

UEN Executive Director

margaret@iowaschoolfinance.com

515.201.3755 Cell

Thanks to our 2024-25 UEN Corporate Sponsors:

Special thank you to your UEN Corporate Sponsors for their support of UEN programs and services. Find information about how these organizations may help your district on the Corporate Sponsor page of the UEN website at www.uen-ia.org/uen-sponsors.

- Solution Tree - www.solutiontree.com/st-states/iowa