Capitol Update - January 27, 2022

UEN Legislative Update

Jan. 27, 2022

In this UEN Weekly Report from the 2022 Legislative Session, find information about:

- More information about the fiscal impact of 2.5% SSA as recommended by the Governor

- House and Senate Republican Tax Plans Introduced

- Status of School Choice Conversations

- Bills on the Move

- Advocacy Action Steps for This Week

- Links to Advocacy Resources

- Members of the House and Senate Education Committees

Week Three of the 2022 Session: Initial subcommittees are held on minor policy bills and still no action on education funding in the House and Senate.

Update on School Funding SSA: Governor Reynolds recommended 2.5% increase in the State Cost Per Pupil, known as SSA. See the Jan. 13 report for details. Since no bill has been introduced in the House and Senate, there is still time to advocate with your legislators and encourage them to push the number a bit higher. See the ISFIS New Authority Report for impact of the 2.5% recommendation. Change the dropdown box to any other percentage you’d like to compare.

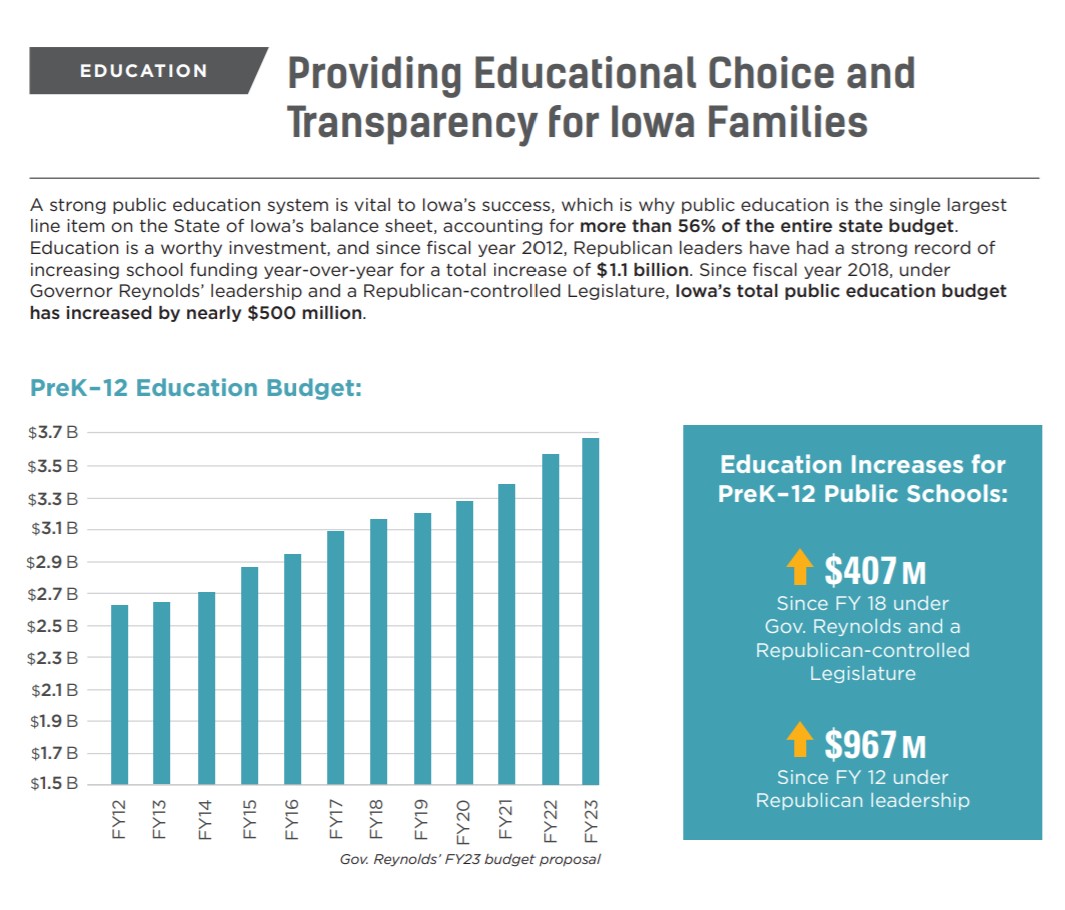

- 56% of the state budget includes universities, community colleges, private tuition grants, and others.

- 56% of what? Income tax cuts over the last 2-3 years made the pie relatively smaller.

- The NASBO (National Association of State Budget Officers) annual State Expenditure Report analyzes all state expenditures: In FY 2021, Iowa’s education expenditures were 16.5% of total state expenditures. Plains states averaged 18.2%. All states averaged 18.9%.

- $407 Million increase since FY 2018 for PreK-12 Public Schools also gives us pause. That is a correct number, however, $122.3 million of that, or 30%, was property tax relief (PTRP growth, SAVE revenue diversion, C&I Property Tax Hold Harmless, etc.) Another way to say this, had they not used the formula for property tax relief, that $122.3 million could have provided an additional 3% SSA.

- See the UEN Issue Brief Adequate School Funding, which has additional school funding talking points and comparisons to economic measures you can share with your legislators.

Republican Legislative Tax Plans Introduced

The Thursday, Jan. 27 IANLS Newsletter reported this evening the details of the House and Senate Republicans Tax Plans assigned to subcommittees today:

HSB 626 House Tax Plan (Ways & Means) Subcommittee of Reps. Hein (C), Hite, Bloomingdale, Jacoby, and Isenhart. The bill contains the following provisions:

Income Tax: Phases in the flat tax from 2023 to 2025. Reduces the number of brackets and rates until reaching 4% on all taxable income in the tax year 2026 and after.

Retirement income: Increases the retirement income exclusion to cover all income. Does not use such excluded income in calculations to determine net income.

Capital Gains: Allows an employee-owner to take a one-time irrevocable election to exclude the capital gain from the sale of stock from the income tax. Requires the corporation to have employed Iowans for at least ten years, to have had specific numbers of shareholders and meet other requirements. Phases in the provisions over three years.

Farmers: Excludes payments for leased farmland to retired farmers. Requires the farmer to be 55, to no longer be farming and for the farmer to have farmed the land for at least ten years. Expands the capital gains exclusion for farmers to include retired farmers, and excludes the sale of cattle and horses and for breeding livestock. Similar to HSB 551/SSB 3044 (Governor) & SSB 3074 (Senate).

SSB 3074 Senate Tax Plan (Ways & Means) Subcommittee of Sens. Dawson (C), Bolkcom, Jochum, R Smith, and Zaun. The bill contains the following provisions:

Sales Taxes: Repeals local option sales taxes and increases the state sales tax to 7%. Scoops 0.375% of the increase for the Natural Resources & Outdoor Recreation Trust fund. Changes REAP funding. Ends sales tax exemptions for web hosting and cloud computing and for the sales of software and some digital services. Makes changes in administrative/filing matters related to the sales tax.

Sales Tax Increases: Increases the taxes for automobile rentals, equipment and water service.

Income Tax: Phases in the flat tax from 2023 to 2027. Reduces the number of brackets and rates until reaching 3.6% on all taxable income in the tax year 2027 and after. Changes the Taxpayer Trust Fund to the Income Tax Elimination fund with a mechanism to reduce and eventually eliminate the income tax. Retirement income: Increases the retirement income exclusion to cover all income. Does not use such excluded income in calculations to determine net income.

Corporate Income: Reduces corporate tax rates until the rates reach 5.3%/7.8% in the 2028 tax year. Franchise Tax: Reduces the franchise tax to 4% by the 2027 tax year.

Capital Gains: Allows an employee-owner to take a one-time irrevocable election to exclude the capital gain from the sale of stock from the income tax. Requires the corporation to have employed Iowans for at least ten years, to have had specific numbers of shareholders and meet other requirements. Phases in the provisions over three years.

Farmers: Excludes payments for leased farmland to retired farmers. Requires the farmer to be 55, to no longer be actively farming and for the farmer to have farmed the land for at least ten years. Expands the capital gains exclusion for farmers to include retired farmers, and to exclude the sale of cattle and horses and for breeding livestock.

National Guard: Exempts the military pay of Guard members.

Tax Credits: Makes changes to reduce or eliminate tax credits.

Requests a review committee in 2029. Similar to HSB 551/SSB 3044 (Governor) & HSB 626 (House).

School Choice Status

The Governor’s voucher bill has not yet been introduced. SF 128, resurfacing from the 2021 Session, was considered in a Senate Subcommittee this week. The bill would create and Education Savings Account for students currently in public schools who want to go to private schools or for incoming kindergarten students. Fifty percent of the per pupil cost would go to the student’s ESA. This would grow to a costly voucher program, inhibiting the state’s ability to adequately fund public schools in the future. Public funding should be for public schools, period. Public funds require public accountability and transparency. This plan is a slippery slope toward a costly and expansive voucher program. The bill was approved in Subcommittee, 2:1 on party lines, moving it to the full Senate Education Committee. See the UEN Issue Brief School Choice which has additional information about Iowa’s current school choice options and explains how vouchers have not netted positive results across the nation. UEN is registered opposed to this bill.

House Committee Action:

HSB 518 Teacher Resignation Deadlines (Education. Will receive a new bill number.) This bill requires a teacher to file a written resignation on or before the later of the date specified by the employing board or June 30 of the current school year. UEN is registered opposed.

HSB 541 Last Dollar Scholarships (Education. Will receive a new bill number.) This bill allows high school graduates to qualify for Last Dollar Scholarships for part-time postsecondary education. Current law limits the scholarships to full-time post-secondary education. The bill was approved by the House Education Committee. UEN is registered as undecided.

HSB 581 Teacher Bona Fide Retirement (State Government. Will receive a new bill number.) This bill originally would have excluded the employment of a licensed teacher for a non-administrative position as covered employment in terms of determining a bona fide retirement under IPERS, between July 2022 through July 2026. This action would have jeopardized the tax-exempt status of the IPERS fund. The Subcommittee agree to amend the bill to strike the original idea and instead, raise the $30,000 income limitation before negative IPERS income limitations to $50,000. The Committee approved the bill, sending it to the House Calendar. UEN is registered in support of the bill.

HF 2037 Shared Operational Functions (Education. Will receive a new bill number.) This bill increases the supplementary weighting for schools that share operational superintendent management functions from 8 students to 9 students. Passed 23-0; FM: Dolecheck. UEN is registered as undecided.

Senate Education Committee Action

SF 2129 Last Dollar Scholarships (Education; Successor to SSB 3046.) This bill allows high school graduates to qualify for Last Dollar Scholarships for part-time postsecondary education. Current law limits the scholarships to full-time post-secondary education. The bill was approved 14:0 by the Senate Education Committee. UEN is registered as undecided.

SF 2128 ELL Terminology (Education; Successor to SSB 3047.) This bill changes all references in the Iowa code from Limited English Proficient to English Learners. The bill does not change weightings associated with either category of EL services. The bill was approved 14:0 by the Senate Education Committee. UEN is registered as undecided.

House Bills

HSB 574 School Year Start Date (Hite) (Education) This bill strikes Iowa Code provisions that prohibit a school from beginning before August 23. Requires schools to adopt a school calendar beginning after June 1 or before August 15 by the preceding February. Subcommittee of T. Moore, Brink and Gaines met and heard testimony from the education community and the tourism industry. The decided to table the bill and not move it forward. However, there was some willingness to consider broader waivers for year-round-school in the future. UEN is registered in support.

HF 2009 School Resource Officers: (Lohse) (Education) Subcommittee of Wheeler, Mascher and Salmon met and discussed the bill which would have allowed use of management fund for the costs of one school resource officer. Subcommittee members were concerned about the impact on property taxes, as was the Farm Bureau. They all agreed they would consider the bill is there was a different funding source specified. UEN is registered in support.

HF 2021 Student Teaching Requirements: (Gobble) (Education) Subcommittee of Reps. Brink (CH), Gobble, and Mascher. The Subcommittee met, agreed to amend the bill to delete any reference to the Praxis or other pre-service assessments, and limited the action of the bill to require 80 hours of pre-student teaching field experiences, which matches the requirement in DE administrative rules. The bill moves forward to the House Education Committee. UEN is registered as undecided.

HF 2099 HS Civics Instruction: (Gobble & Wills) (Education) This bill requires High School students to have one unit each of US government (current law requires ½ unit), US history (adds Iowa history to that unit) and one unit of civics. Includes very prescriptive requirements for the courses regarding instruction on the US Constitution, voting procedures, and objective analysis of other ideologies through world history. Requires public school students to be given a multiple-choice test on US government similar to the test required for citizenship and for the DE to publish the results on the internet. The bill also requires the annual audit to report on compliance with this requirement. Similar to HF 2060. UEN is registered in opposition since this is an unfunded mandate.

HF 2100 School Alternative Energy Programs (Gobble) (Education): This bill requires the DOE to develop an alternative energy innovation program, in consultation with the Regents, the IUB and the Utilities Division, in order to give students in schools or in higher education training and instruction related to solar and wind energy equipment. Establishes a fund for grants to school for the installation of solar and wind energy facilities. Caps the grants at $500,000 per school year and limits the amount to a percentage of the costs. Allows the school to sell energy back to utilities, with any money used for in-classroom expenses. UEN is registered in support.

HF 2109 Hotline Numbers on Student ID Cards (Kressig & Brown-Powers) A Subcommittee of Reps. Bossman, Smith and Sorensen is assigned. (Education) This bill requires public schools to include Iowa Crisis hotline and text numbers on grade 7-12 student IDs. Encourages the inclusion and grades 5-6 IDs. Allows the schools to use up any existing stock before meetings these requirements. Similar to SF 2075. UEN is registered as undecided.

HF 2132 Restricting School Board Comments (Gobble) (Education) This bill allows school boards to restrict comments at meetings to parents and guardians of students in the district. UEN is registered as undecided.

Senate Bills

SSB 3064 Supermajority Tax Increase Approval (Ways & Means) Subcommittee of Sens. Dawson, Goodwin and Petersen. This bill proposes an amendment to the Constitution requiring a supermajority (2/3) vote of both chambers to increase a tax or impose a new tax. Requires lawsuits challenging any bill subject to this 2/3 must be filed within a year of enactment, or the bill is considered properly enacted. UEN is registered opposed.

SF 89 Cursive Writing: (Carlin) (Education)Subcommittee of Sens. Carlin, Johnson and Trone Garriott. This bill would require school districts to include cursive handwriting instruction with a goal of cursive proficiency and legible writing by 3rd grade. The Subcommittee agreed to move the bill forward 2:1 on party lines. The bill moves to the full Senate Education Committee. UEN is registered opposed.

SF 2003 At-risk/Dropout Prevention Funding: (Cournoyer) (Education) Subcommittee of Sens. Cournoyer, Goodwin and Trone Garriott. This bill raises the 2.5% funding cap gradually until it reaches 5% for all school districts by 2026. The Subcommittee unanimously approved the bill to move forward to the full Education Committee. UEN is registered in support.

SF 2107 Technology and Learning (Carlin) (Education): this bill requires the DE to convene a workgroup to study the impact of technology on learning and to report on the matter by December 2022. UEN is registered as undecided.

SF 2112 Achievement Gap Study (Carlin) (Education): this bill requires the DE to convene a working group to student any academic disparities between groups of K-12 students and to report by December 2022. UEN is registered as undecided.

Advocacy Actions This Week

- Always start with a thank you! See the 2021 Legislative Session Successes on the UEN website and find one you are grateful for them accomplishing.

- Explain the SSA numbers to your legislators, especially in light of inflation and workforce shortage. Talking points:

- Supplemental state aid is the biggest source of per pupil funding in Iowa, but our funding has not kept pace nationally, putting our students and state at a disadvantage. Sufficient funding provides for a high-quality education that translates to a successful future and economic growth in our state.

- As a result of the legislature eliminating the Commercial and Industrial Replacement payment for school districts but increasing the foundation level, the cost of school aid will increase by $59 million without providing any new money to school districts. The funding source becomes the state general fund instead of local property taxes.

- Inflation and cost-of-living increases should be considered when determining school aid funding. School districts must pay competitive salaries to retain teachers and staff, especially during a labor shortage. The legislature should provide funding that considers the impact inflation has on recruiting and retaining school employees. PERB has set a CPI-U of 7.5% for June arbitrations. (Although arbitrators are limited to the lower of 3% or that CPI-U rate, the inflation factor is a sign of private-sector wage growth and competition for school employees.)

- School funding is enrollment-driven and increases in enrollment impact the supplemental state aid amount. On the flip side, declining enrollment combined with low SSA means more rural schools will have to consolidate or face closure by the state because they depend on adequate state funding to remain open.

- Low SSA amounts also lead to more districts being eligible for budget guarantee, which shifts the funding burden to local property taxpayers. At the Governor’s proposed 2.5% SSA, 82 districts would be eligible for the budget guarantee at a total cost to property taxpayers of $9.1 million.

Find more SSA information and talking points in the UEN Issue Brief on Adequate Funding on the UEN website here.

- Shore up Voucher Opposition: Circle back with your legislators who’ve previously told you they opposed vouchers and reiterate key messages:

- Use public dollars for public schools. Period.

- Public funds require public accountability and transparency.

- A slippery slope toward a costly an expansive voucher program.

- Iowa already has many parent choice options

Gratitude: Tell your legislators and the Governor thank you for the preschool funding supplement through the SBRC. THANK YOU for getting that done. (We will need to do it again this coming year.)

Connecting with Legislators: To call and leave a message at the Statehouse during the legislative session, the House switchboard operator number is 515.281.3221 and the Senate switchboard operator number is 515.281.3371. You can ask if they are available or leave a message for them to call you back. You can also ask them what’s the best way to contact them during session. They may prefer email or text message or phone call based on their personal preferences.

UEN Advocacy Resources: Check out the UEN Website at www.uen-ia.org to find Advocacy Resources such as Issue Briefs, UEN Weekly Legislative Reports and video updates, UEN Calls to Action when immediate advocacy action is required, testimony presented to the State Board of Education, the DE or any legislative committee or public hearing, and links to fiscal information that may inform your work. The latest legislative actions from the Statehouse will be posted at: www.uen-ia.org/blogs-list. See the newly released 2022 UEN Advocacy Handbook, which is also available from the subscriber section of the UEN website

Education Committee Members in the Senate and House:

Senate Members

- Amy Sinclair (R, District 14), Chair

- Jeff Taylor (R, District 2), Vice Chair

- Herman C. Quirmbach (D, District 23), Ranking Member

- Jim Carlin (R, District 3)

- Claire Celsi (D, District 21)

- Chris Cournoyer (R, District 49)

- Eric Giddens (D, District 30)

- Tim Goodwin (R, District 44)

- Craig Johnson (R, District 32)

- Tim Kraayenbrink (R, District 5)

- Ken Rozenboom (R, District 40)

- Jackie Smith (D, District 7)

- Annette Sweeney (R, District 25)

- Sarah Trone Garriott (D, District 22)

- Brad Zaun (R, District 20)

House Members

- Dustin D. Hite (R, District 79), Chair

- Skyler Wheeler (R, District 4), Vice Chair

- Sharon Sue Steckman (D, District 53), Ranking Member

- Jacob Bossman (R, District 6)

- Holly Brink (R, District 80)

- Sue Cahill (D, District 71)

- Cecil Dolecheck (R, District 24)

- Tracy Ehlert (D, District 70)

- Joel Fry (R, District 27)

- Ruth Ann Gaines (D, District 32)

- Eric Gjerde (D, District 67)

- Garrett Gobble (R, District 38)

- Chad Ingels (R, District 64)

- David Kerr (R, District 88)

- Mary Mascher (D, District 86)

- Thomas Jay Moore (R, District 21)

- Sandy Salmon (R, District 63)

- RasTafari Smith (D, District 62)

- Ray Sorensen (R, District 20)

- Art Staed (D, District 66)

- Henry Stone (R, District 7)

- Phil Thompson (R, District 47)

- John H. Wills (R, District 1)

Contact us with any questions, feedback or suggestions to better prepare your advocacy work:

Margaret Buckton

UEN Executive Director/Legislative Analyst

margaret@iowaschoolfinance.com

515.201.3755 Cell